Ercros obtains a profit of 8 million euros in the first quarter

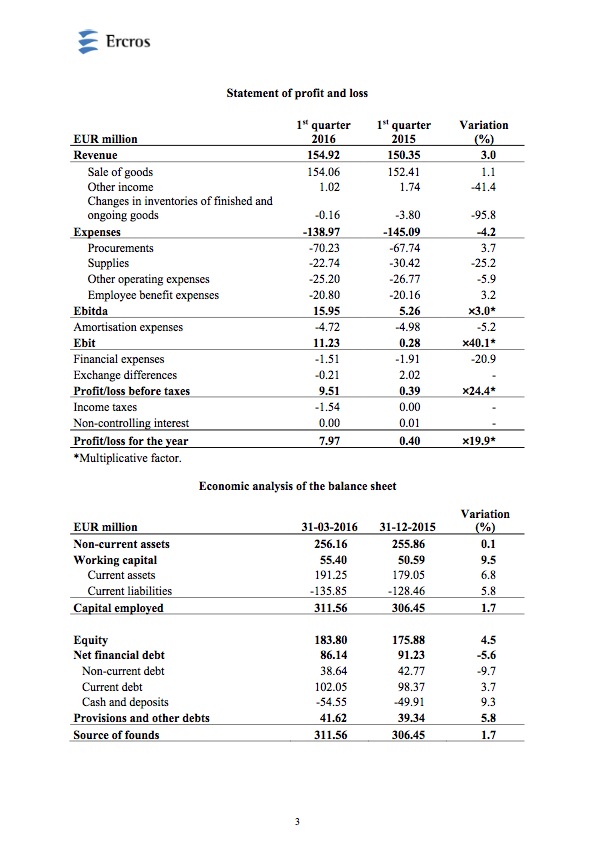

Barcelona, May 2, 2016. - Ercros has concluded the first quarter of 2016 with a profit of EUR 7.97 million, a figure that exceeds EUR 7.57 million the profit for the same period in 2015 which amounted to EUR 0.40 million, and also exceeds the profit for the whole year 2015, which amounted to 7.24 million euros.

This benefit reflects the result of the strategy implemented by the company and the restructuring actions undertaken in recent years, which have enabled a better use in terms of profitability of the economic activity recovery, and consolidates the upward trend highlighted throughout last year. The result of the first quarter is also particularly significant because it comes in a period of traditional seasonal weakness in the chemical industry, such as the first three months of the year.

The turnover has risen to EUR 154.06 million and has been 1.1% higher than the same period last year.

This increase in sales is due to the prices, while volumes, after the sale of the factory in Palos de la Frontera and Salina de Huelva last June 2, 2015, were 1.6 % lower than in 2015. The divisions that had a better evolution in sales have been plastics and pharmaceutical, whose business figures have experienced rises above 11%

On the expenditure side, the main change has occurred in the supply section, which amount has decreased by EUR 7.68 million compared to the same period in 2015. After the upward rising price of electricity in recent years, in this quarter the trend has reversed and the electricity bill has dropped more than 25%. Also the gas, supported by the low price of oil, has experienced a downward trend and this quarter the bill has decreased by 38%.

Expenses have increased by EUR 2.49 million, (i) due to the uneven performance of raw materials, while in the case of ethylene the price has moderately increased (+5%), in the case of methanol price has decreased by 30%, and (ii) due to increasing purchases of products for marketing.

Personnel costs, amounting to EUR 20.80 million, increased by 0.64 million between the first quarter of 2015 and 2016. In this case, the effect of lower staff, mainly as a result of the sale of factory in Palos de la Frontera and Salina de Huelva, is partly offset by the 3.5% wage increase applied. This wage increase includes the outstanding recovery of frozen salaries from the years 2010-2012.

The combined effect of a 3% improvement in revenue with a reduction of 4.2% of expenditures raises the gross operating profit (“ebitda”) for the first quarter of 2016 to EUR 15.95 million; three times the result obtained in the first quarter of 2015, which was EUR 5.26 million, and it means an improvement of EUR 10.69 million.

Between the first quarter of 2015 and 2016, the ebitda margin on sales rose from 3.5% to 10.4%, almost seven points.

As amortization expenses, amounting to EUR 4.72 million, have declined slightly in the period under review, the operating result (“ebit”), which reached EUR 11.23 million, experienced an increase of EUR 10.95 million, an amount slightly higher than the increase experienced by the ebitda.

In terms of the financial results, it should be noted the reversal of the exchange differences which have been negative amounting to EUR 0.21 million, due to the depreciation of the dollar against the euro, compared to EUR 2.02 million positive difference in the first quarter of 2015, a period in which the dollar appreciated sharply against the euro. Financial expenses, meanwhile, have decreased by EUR 0.4 million compared to the first quarter of 2015 mainly due to the reduction of financial debt.

On the other hand, the company has registered in the first quarter of 2016 expenses for income tax by EUR 1.54 million.

Thus, net profit for the quarter reached the figure of EUR 7.97 million, EUR 7.57 million above the result achieved in the first quarter of 2015 (EUR 0.40 million). A result that virtually multiplies by 20 the one obtained 12 months ago and becomes a clear sign of the upward trend in which the company is installed.

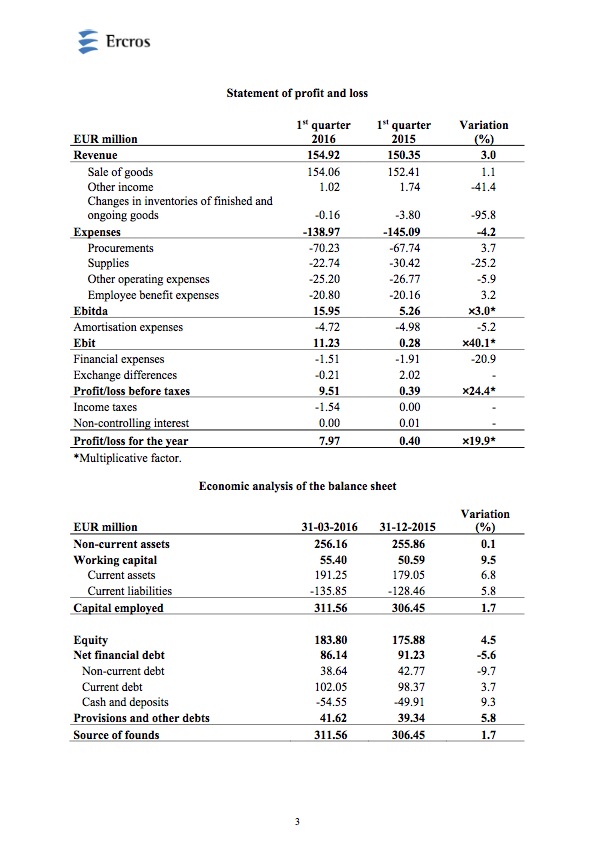

From the balance sheet, it should be highlighted the increase in working capital by EUR 4.81 million, due to the higher volume of current assets, which in turn reflects the increase in sales experienced between December 31, 2015 and March 31, 2016.

The increase in equity, by EUR 7.92 million, is a consequence of the profits obtained. The higher cash generation has also enabled a decrease by EUR 5.09 million in the net financial debt, which stood in late March at EUR 86.14 million.

Between December 31, 2015 and March 31, 2016, the ratio between net financial debt and the sum of equity plus net financial debt, which m

easures the level of indebtedness of the company in relation to the resources available and therefore, the solvency of the company, improved from 0.34 to 0.32. In this same period, the ratio obtained between net debt and Ebitda of the last 12 months also improved from 5.97 to 2.00, a very significant reduction that clearly reflects the significant improvement in the ability of company to face its debts.

Download document

Download document

This benefit reflects the result of the strategy implemented by the company and the restructuring actions undertaken in recent years, which have enabled a better use in terms of profitability of the economic activity recovery, and consolidates the upward trend highlighted throughout last year. The result of the first quarter is also particularly significant because it comes in a period of traditional seasonal weakness in the chemical industry, such as the first three months of the year.

The turnover has risen to EUR 154.06 million and has been 1.1% higher than the same period last year.

This increase in sales is due to the prices, while volumes, after the sale of the factory in Palos de la Frontera and Salina de Huelva last June 2, 2015, were 1.6 % lower than in 2015. The divisions that had a better evolution in sales have been plastics and pharmaceutical, whose business figures have experienced rises above 11%

On the expenditure side, the main change has occurred in the supply section, which amount has decreased by EUR 7.68 million compared to the same period in 2015. After the upward rising price of electricity in recent years, in this quarter the trend has reversed and the electricity bill has dropped more than 25%. Also the gas, supported by the low price of oil, has experienced a downward trend and this quarter the bill has decreased by 38%.

Expenses have increased by EUR 2.49 million, (i) due to the uneven performance of raw materials, while in the case of ethylene the price has moderately increased (+5%), in the case of methanol price has decreased by 30%, and (ii) due to increasing purchases of products for marketing.

Personnel costs, amounting to EUR 20.80 million, increased by 0.64 million between the first quarter of 2015 and 2016. In this case, the effect of lower staff, mainly as a result of the sale of factory in Palos de la Frontera and Salina de Huelva, is partly offset by the 3.5% wage increase applied. This wage increase includes the outstanding recovery of frozen salaries from the years 2010-2012.

The combined effect of a 3% improvement in revenue with a reduction of 4.2% of expenditures raises the gross operating profit (“ebitda”) for the first quarter of 2016 to EUR 15.95 million; three times the result obtained in the first quarter of 2015, which was EUR 5.26 million, and it means an improvement of EUR 10.69 million.

Between the first quarter of 2015 and 2016, the ebitda margin on sales rose from 3.5% to 10.4%, almost seven points.

As amortization expenses, amounting to EUR 4.72 million, have declined slightly in the period under review, the operating result (“ebit”), which reached EUR 11.23 million, experienced an increase of EUR 10.95 million, an amount slightly higher than the increase experienced by the ebitda.

In terms of the financial results, it should be noted the reversal of the exchange differences which have been negative amounting to EUR 0.21 million, due to the depreciation of the dollar against the euro, compared to EUR 2.02 million positive difference in the first quarter of 2015, a period in which the dollar appreciated sharply against the euro. Financial expenses, meanwhile, have decreased by EUR 0.4 million compared to the first quarter of 2015 mainly due to the reduction of financial debt.

On the other hand, the company has registered in the first quarter of 2016 expenses for income tax by EUR 1.54 million.

Thus, net profit for the quarter reached the figure of EUR 7.97 million, EUR 7.57 million above the result achieved in the first quarter of 2015 (EUR 0.40 million). A result that virtually multiplies by 20 the one obtained 12 months ago and becomes a clear sign of the upward trend in which the company is installed.

From the balance sheet, it should be highlighted the increase in working capital by EUR 4.81 million, due to the higher volume of current assets, which in turn reflects the increase in sales experienced between December 31, 2015 and March 31, 2016.

The increase in equity, by EUR 7.92 million, is a consequence of the profits obtained. The higher cash generation has also enabled a decrease by EUR 5.09 million in the net financial debt, which stood in late March at EUR 86.14 million.

Between December 31, 2015 and March 31, 2016, the ratio between net financial debt and the sum of equity plus net financial debt, which m

easures the level of indebtedness of the company in relation to the resources available and therefore, the solvency of the company, improved from 0.34 to 0.32. In this same period, the ratio obtained between net debt and Ebitda of the last 12 months also improved from 5.97 to 2.00, a very significant reduction that clearly reflects the significant improvement in the ability of company to face its debts.

Ercros garantiza que los hechos relevantes que figuran en esta página se corresponden exactamente con los remitidos por la Sociedad a la CNMV, y difundidos por ésta al mercado. Los hechos anteriores a los incluidos en este apartado, se encuentran disponibles en la web de la CNMV.